Design A Life of Purpose

Reduced Anxiety

Having a CERTIFIED FINANCIAL PLANNER™ Professional is like having a Coach on your corner at all times. Questions that come up, situations that need addressed – we’re here with you through it all.

More Time (to do what you love)

To make proper financial decisions, there’s a lot to learn. Working with a coach cuts down the learning curve and helps you feel more confident in your decisions.

Schedule a No-Obligation, Hassle-Free Consultation

So Why Us?

Highest Level of Fiduciary and Professional Standards.

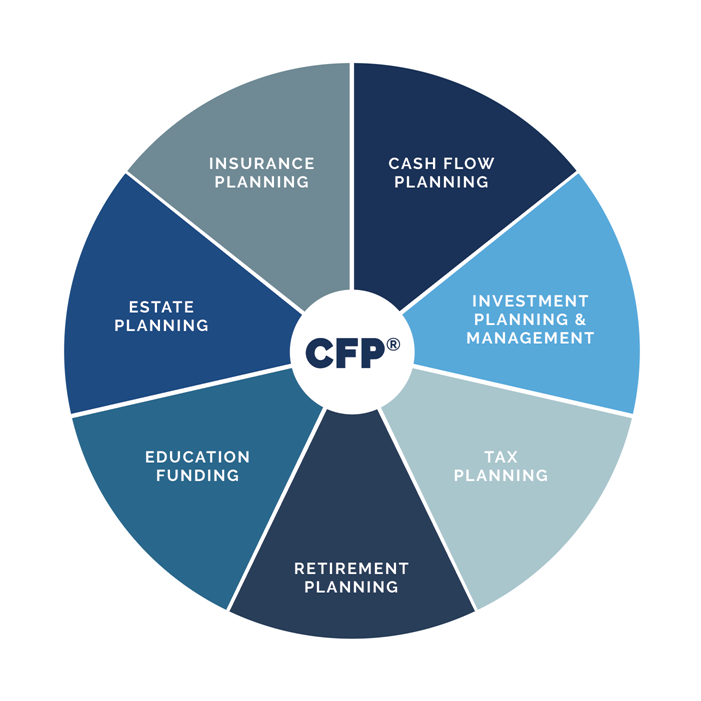

Our CERTIFIED FINANCIAL PLANNER™ professionals adhere to the highest ethical and professional standards to ensure the best possible advice and services to our clients. This includes maintaining confidentiality, avoiding conflicts of interest, and acting in your best interest at all times.

Independent, Holistic Financial Planning customized to your Unique Circumstances.

Our team of professionals and other specialists are not associated with any financial company or broker dealer so you can expect straightforward and objective advice. We also have qualified fiduciaries that are Hispanic and Women Planners and Advisors.

Timely, Responsible, and Transparent Communication and Collaboration.

These are essential keys when advising on relevant and essential planning decisions in your life. Our clients are expected to be transparent about their financial situation, goals, and concerns, while planners actively listen and respond to their clients’ unique needs and wants.

Learn: How Can We Help?

- MODERN FINANCIAL ADVICE Captures a “Real Time” view of your present financial health condition.

- MONITOR & MEASURE over eleven (11) uniquely defined, personal financial data elements relevant to your financial health.

- REVIEW & DISCUSS this timely information…via an app or on (1) One Page for you and your CERTIFIED FINANCIAL PLANNER™ Professional guide.

- COMPREHESIVE FINANCIAL PLANNING is a Life journey, not a destination.

- It is an evolving process that adapts to your changing life circumstances while considering all relevant and timely aspects of your financial life.

To Decide On Your Next Step

About Antonio (Tony) Lugo, CFP®, MBA

CERTIFIED FINANCIAL PLANNER™ Professional

Chartered Retirement Planning Counselor™

Bilingual in English and Spanish

I believe A Good Life Doesn’t Plan Itself

If change in life is expected then how prepared are you? What is your plan and strategy? How adaptable and realistic is it? I believe REAL financial planning begins in having REAL conversations. In doing so, it allows us to discuss your experiences, your values, and your goals. From there, we can then assess where you are today and what can I do to help you plan a better tomorrow for you and family.

See What Our Clients Say About Antonio (Tony) Lugo

Links to third party websites are for general information purposes only and do not constitute any offer or solicitation to buy or sell any services or products of any kind. The other parties are responsible for the content on their website(s). You are encouraged to read and evaluate the privacy and security policies on the specific site you are entering. They are not intended and should not be relied upon as investment, insurance, financial, tax, or legal advice.

(BCM), a registered investment advisor. BCM and Smart Wealth Strategies are

independent of each other. Insurance products and services are not offered through BCM but are offered and sold through individually licensed and appointed agents.

© 2026. Smart Wealth Strategies 125 S. Wacker Drive, Suite 300, Chicago, IL 60606